Resources

Program resources provide more detailed information on how to qualify and submit your all-electric market-rate new construction project for incentives and bonuses. These resources are designed to help clarify eligibility requirements and how to submit your projects for incentives.

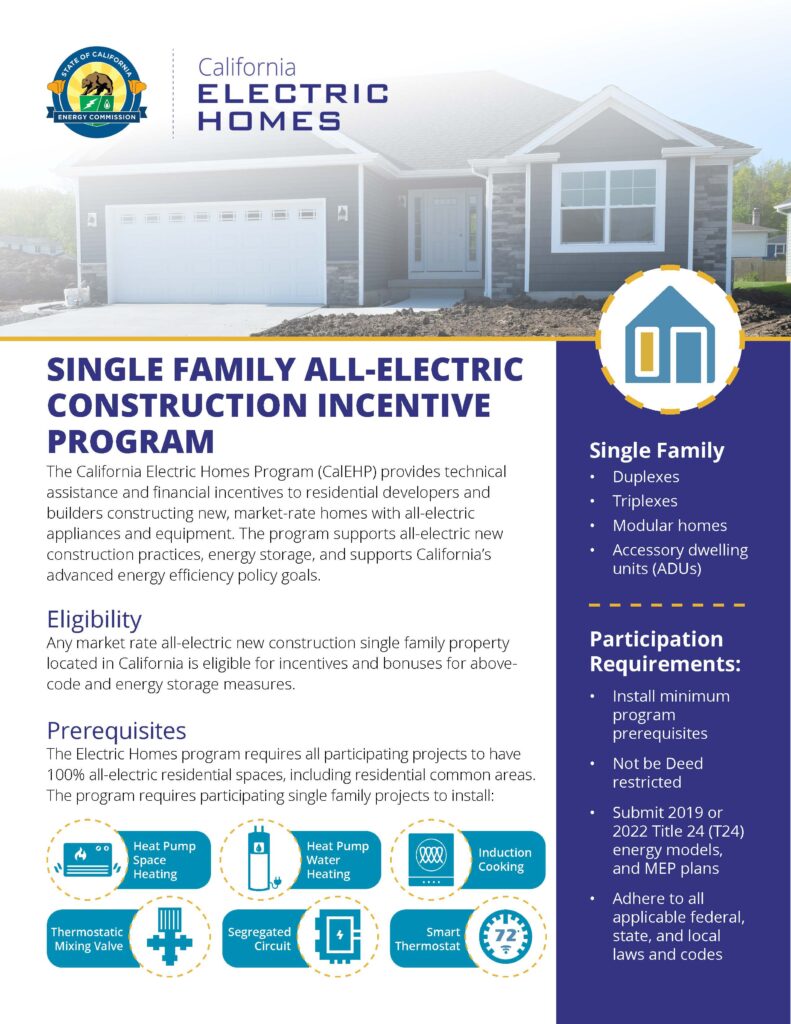

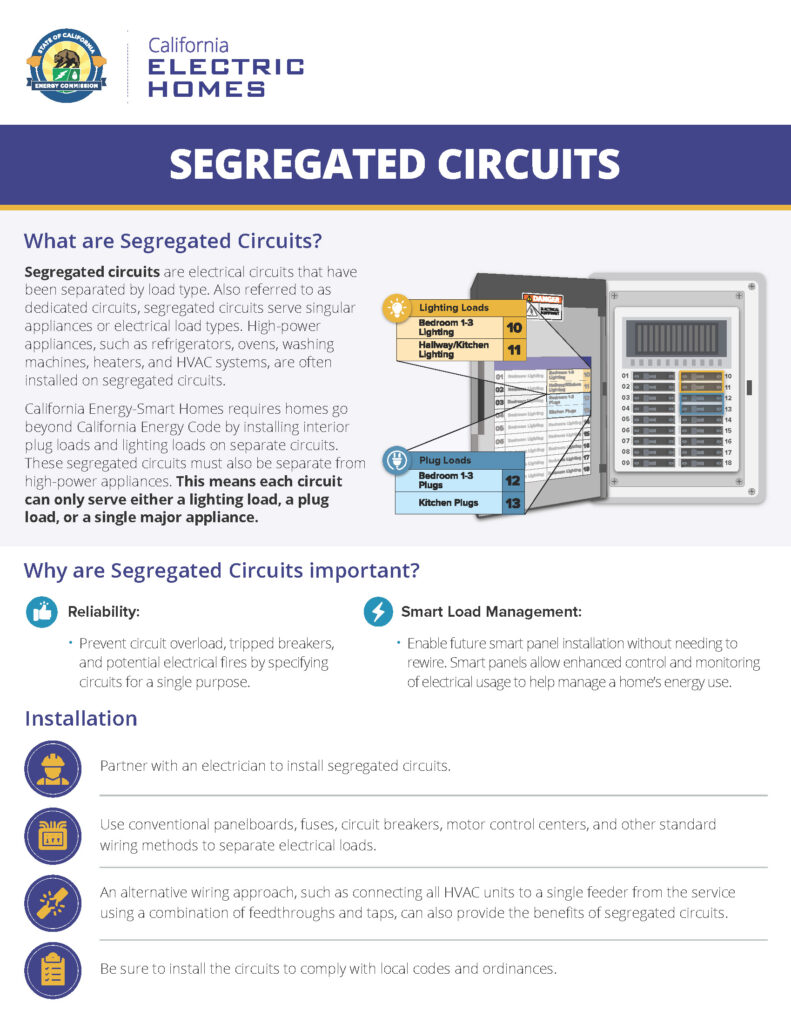

Program Fact Sheets

Program Documents

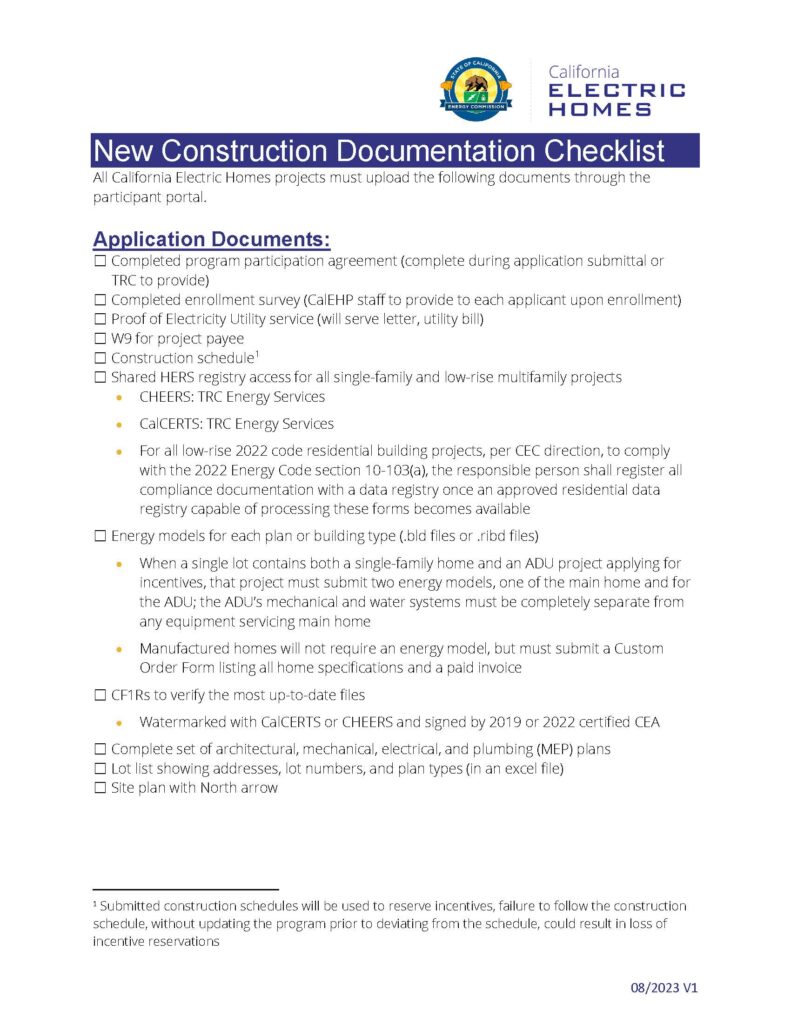

Sample Documents

View sample documents that can help you identify and complete the required documents to enroll your project.

Designing All-Electric Multifamily Buildings? Start Here.

Download the Electrification Guide for Multifamily Properties to confidently integrate all-electric design into your next project.

Created specifically for architects and engineers, this guide offers practical design insights, code considerations, and system solutions to help streamline electrification from concept to construction.

View the California Electric Homes (CalEHP) YouTube Channel for webinar recordings and training videos

Resources for Engaging All-Electric Home Buyers

Visit the Builder Content Portal to view videos and factsheets that help demonstrate the benefits of all-electric homes to buyers and renters. The portal was created by the Switch is On team and is sponsored by CalEHP.